The post Modern Trends in Financial Technologies: USDC as an Instrument of Stability appeared first on Reliance Info.

]]>This article explores the growing significance of stablecoins, particularly USDC, in the FinTech landscape. We will delve into the current trends in financial technologies, examine the role of stablecoins in digital transactions, and highlight how USDC is transforming industries like online payments and gambling.

Current Trends in Financial Technologies

Digital Transformation in Banking and Payments

Over the past decade, the financial services industry has witnessed a massive digital transformation. Traditional banks and payment providers have embraced new technologies to streamline operations, reduce costs, and improve customer experiences. The rise of digital wallets, mobile banking apps, and instant payments has revolutionized the way individuals and businesses conduct transactions. Digital transformation has made financial systems more accessible and efficient, facilitating faster and more secure interactions.

Blockchain and Distributed Ledger Technologies

At the heart of this transformation is blockchain technology, a decentralized and immutable ledger system that underpins cryptocurrencies and stablecoins. Blockchain offers numerous benefits, such as increased transparency, lower transaction costs, and enhanced security. Distributed ledger technology (DLT) has opened up new possibilities for financial systems, allowing for more efficient cross-border transactions, better record-keeping, and the elimination of intermediaries. These advancements have positioned blockchain as a cornerstone of modern financial technologies.

Regulatory Evolution and Compliance Standards

As the FinTech sector continues to grow, regulators have been working to establish frameworks that ensure the safety, security, and fairness of digital financial systems. Governments around the world are introducing new regulations to address the challenges posed by digital currencies, including anti-money laundering (AML) and know-your-customer (KYC) standards. These regulatory efforts aim to create a balance between fostering innovation and protecting users, ensuring that the financial ecosystem remains stable and trustworthy.

Understanding Stablecoins

Definition and Types (Algorithmic vs. Fiat-Collateralized)

Stablecoins are a class of cryptocurrencies that aim to maintain a stable value by pegging their worth to a reserve asset, such as a fiat currency or a commodity. There are two main types of stablecoins: algorithmic and fiat-collateralized. Algorithmic stablecoins use algorithms to control supply and demand, while fiat-collateralized stablecoins are backed by reserves of fiat currency, such as the US dollar.

USDC, for example, is a fiat-collateralized stablecoin, meaning it is backed by a reserve of US dollars. This provides users with a reliable and transparent store of value, making it ideal for use in financial transactions.

Market Dynamics and Adoption Rates

The adoption of stablecoins has surged in recent years, with billions of dollars’ worth of stablecoins circulating in the market. USDC has emerged as one of the most popular stablecoins, with a growing number of businesses integrating it into their payment systems. Stablecoins offer advantages such as lower volatility, faster transaction speeds, and greater security, which have contributed to their rapid adoption.

Comparative Analysis: USDC vs. Other Stablecoins (e.g., Tether, DAI)

USDC stands out from other stablecoins like Tether (USDT) and DAI due to its transparency and regulatory compliance. USDC is issued by Circle, a regulated financial institution, and is subject to regular audits to ensure that each USDC token is backed by an equivalent amount of US dollars. This transparency makes USDC a more trusted option for businesses and individuals who value stability and regulatory oversight.

In contrast, Tether has faced scrutiny over its reserves and transparency, while DAI is a decentralized stablecoin that relies on smart contracts and collateralized assets to maintain its value.

Underlying Technology and Security Protocols

USDC operates on multiple blockchains, including Ethereum, Solana, and Algorand, using the ERC-20 standard for Ethereum. This allows USDC to be easily integrated into existing blockchain networks and enables users to transact across different platforms seamlessly. Additionally, USDC uses strong security protocols, such as multi-signature wallets and cryptographic hashing, to ensure the safety of users’ funds.

USDC: A Detailed Examination

Issuance, Backing, and Transparency

USDC is issued by Circle, a financial technology company that has partnered with Coinbase to form the Centre consortium. Each USDC token is fully backed by a reserve of US dollars, held in regulated financial institutions. This backing ensures that users can redeem USDC at any time for US dollars, providing stability and trust in the asset. Circle publishes regular reports to confirm the backing of USDC, offering transparency that is crucial for businesses and consumers. You can explore more about USDC’s growth and its impact on the digital economy through the State of the USDC Economy report here.

Integration with Traditional and Digital Financial Systems

USDC is designed to integrate seamlessly with both traditional and digital financial systems. It can be used for a wide range of applications, including remittances, cross-border payments, and online gambling. By bridging the gap between traditional finance and blockchain technology, USDC has become a key player in the growing world of digital currencies.

Advantages for Cross-Border Transactions and Financial Inclusion

One of the key benefits of USDC is its ability to facilitate fast, low-cost cross-border transactions. Traditional remittance systems can be slow and expensive, with high fees and long processing times. USDC, on the other hand, allows for near-instantaneous transactions at a fraction of the cost, making it an attractive option for individuals and businesses involved in international trade.

Additionally, USDC has the potential to promote financial inclusion by providing access to digital financial services for individuals in underserved regions. With stablecoins like USDC, people who lack access to traditional banking systems can participate in the global economy and engage in secure, low-cost financial transactions.

Role in Mitigating Volatility in Crypto Markets

One of the main challenges of cryptocurrencies like Bitcoin and Ethereum is their volatility. Prices can fluctuate wildly, making them unsuitable for everyday transactions. USDC mitigates this issue by maintaining a stable value, pegged to the US dollar. This stability makes USDC a more reliable choice for businesses and individuals who want to use digital currencies without worrying about price swings.

USDC in Online Payment Systems

Digital payments have revolutionized industries like e-commerce, online gambling, and gaming. In high-stakes industries, where large transactions occur regularly, speed and security are crucial. Traditional payment methods can be slow and costly, leading to frustration for both businesses and customers. Stablecoins like USDC offer a solution by enabling faster and more secure transactions, improving the overall user experience.

Security, Speed, and Efficiency in Transaction Processing

USDC offers several advantages over traditional payment methods. Transactions involving USDC are processed almost instantly, reducing the time it takes for funds to be transferred between parties. Furthermore, USDC transactions are secure, with blockchain technology providing an immutable and transparent record of every transaction. This eliminates the need for intermediaries, which can introduce delays and additional costs.

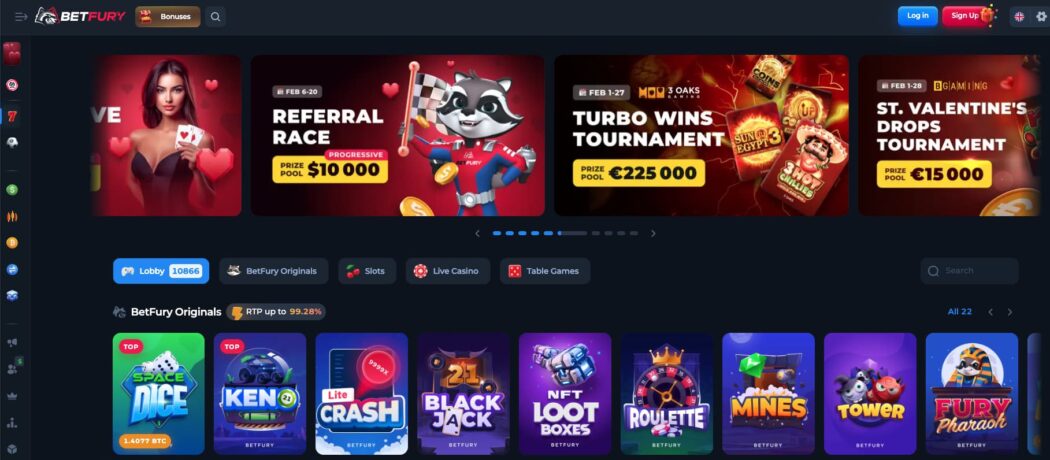

BetFury USDC Casino: A Case Study

BetFury implemented USDC as a stablecoin payment option to provide its players with faster and more secure transactions, minimizing the volatility commonly associated with traditional cryptocurrencies. By integrating USDC, the platform enhanced the user experience, offering quicker deposits and withdrawals compared to conventional payment methods. This move also catered to players seeking stability in their transactions, especially in high-stakes gambling. Alongside USDC, BetFury continues to support a wide range of other cryptocurrencies, giving users more flexibility while ensuring seamless interaction within the crypto ecosystem. The platform’s technical integration allowed for smooth scalability, positioning BetFury to expand its crypto offerings further in the future. More details about how USDC enhances the gambling experience can be found on BetFury’s dedicated USDC Casino page: https://betfury.com/casino/usdc.

Integration Process and Technical Architecture

The integration of USDC into BetFury’s platform was a seamless process, leveraging existing blockchain infrastructure and wallet systems. By incorporating USDC, BetFury was able to offer its players a faster and more secure payment method while minimizing the risks associated with volatility. The platform’s backend systems were designed to handle USDC transactions with high efficiency, ensuring smooth operations even during periods of high demand.

User Experience Improvements and Transaction Efficiency

By adopting USDC, BetFury improved the overall user experience by reducing the time it takes for deposits and withdrawals. Players no longer had to wait for long processing times or worry about fluctuations in cryptocurrency values. This enhanced efficiency not only increased player satisfaction but also helped BetFury attract a broader audience of crypto enthusiasts.

Comparative Benefits over Traditional Payment Methods

USDC offers several key advantages over traditional payment methods. Unlike credit cards or bank transfers, USDC transactions are processed quickly and at a lower cost. Furthermore, USDC’s stability eliminates the risk of price fluctuations, making it a more reliable option for players who want to avoid the volatility of traditional cryptocurrencies.

Scalability and Future Prospects in Online Gambling

As BetFury continues to grow, the integration of USDC positions the platform for future expansion. The scalability of blockchain technology ensures that BetFury can continue to offer a wide range of payment options, including USDC, as the demand for digital currencies in online gambling increases. BetFury’s commitment to innovation and technological advancement ensures that it will remain a leading player in the online gambling space.

Broader Impact on the Business Ecosystem

Enhancing Transparency and Trust in Financial Transactions

USDC’s transparency and regulatory compliance help foster trust in the financial system. With regular audits and transparent backing, USDC offers a level of accountability that is often lacking in other cryptocurrencies. This transparency enhances trust among users, making it an attractive option for businesses and consumers alike.

Integration with Decentralized Finance (DeFi) Platforms

USDC has become an integral part of the decentralized finance (DeFi) ecosystem, allowing users to access a wide range of financial services, including lending, borrowing, and trading. By integrating USDC into DeFi platforms, users can take advantage of the stability and security offered by the stablecoin, while also participating in the innovative world of decentralized finance.

Risk Management and Fraud Prevention Strategies

The security features of USDC make it an ideal tool for risk management and fraud prevention. Blockchain technology ensures that every transaction is recorded on an immutable ledger, reducing the risk of fraud and double-spending. This makes USDC a more secure option compared to traditional payment methods, which are vulnerable to chargebacks and fraud.

Strategic Partnerships between Financial Institutions and Tech Innovators

As USDC gains traction, we can expect to see more strategic partnerships between financial institutions and technology companies. These partnerships will help drive innovation in the payments space, enabling the development of new financial products and services that leverage the power of blockchain technology.

Challenges and Considerations

Despite its many advantages, USDC and other stablecoins face several challenges. Regulatory compliance is a key issue, as governments around the world seek to establish clear guidelines for the use of digital currencies. Additionally, technical integration and interoperability concerns must be addressed to ensure seamless operations across different platforms.

Future Trends and Projections

The future of stablecoins looks promising, with growing adoption and integration across various industries. As regulatory frameworks evolve and blockchain technology continues to improve, stablecoins like USDC will play an increasingly important role in shaping the future of finance. We can expect to see more use cases beyond online gambling, including in remittances, e-commerce, and traditional banking.

Conclusion

USDC has established itself as a key player in the world of digital currencies, offering stability, speed, and security for financial transactions. Its role in online payment systems, particularly in high-stakes industries like online gambling, has demonstrated its potential to enhance user experience and streamline transaction processing. As the digital economy continues to evolve, USDC will likely play an even greater role in shaping the future of finance, offering businesses and consumers a stable and reliable alternative to traditional payment methods.

The post Modern Trends in Financial Technologies: USDC as an Instrument of Stability appeared first on Reliance Info.

]]>The post How Coaching Can Rewire Your Mind for Success appeared first on Reliance Info.

]]>What’s the Deal with Mindset Coaching?

Here’s the thing: most of what holds us back isn’t external—it’s internal. We all carry around a mix of beliefs, fears, and habits that shape our decisions. Some of these are useful, but others? Not so much. They keep us playing small, avoiding risks, and doubting our own potential.

Coaching helps you get real about what’s going on inside your head and rewrite the script. It’s about swapping out old, limiting beliefs for ones that actually serve you, so you can make better choices and, ultimately, get better results.

Why Mindset Beats Strategy (Every Time)

You can have the perfect game plan, but if you don’t believe in yourself, it won’t matter. Take two people with the same skills, experience, and opportunities—one thrives while the other stays stuck. The difference? Mindset.

When you believe something is possible, you look for solutions. When you don’t, you look for excuses. Coaching flips the switch, helping you see possibilities where you once saw roadblocks.

The Core of a Mindset Reset

1. Ditch the Mental Junk

Most of us have picked up limiting beliefs somewhere along the way—things like “I’m not good with money” or “I’m not leadership material.” These ideas are like bad software running in the background, slowing everything down. Coaching helps you identify and uninstall them.

2. Master Emotional Smarts

Being book-smart is great, but if you can’t handle stress, setbacks, or difficult conversations, you’ll hit a ceiling fast. Coaching builds emotional intelligence, making it easier to navigate challenges and connect with people in a way that actually moves things forward.

3. Act Like the Person You Want to Become

You don’t achieve success and then start thinking like a successful person—it’s the other way around. Coaches help you shift into that future version of yourself now, so the habits and mindset you need to succeed become second nature.

4. Use Your Brain’s Built-in Cheat Codes

Science backs this up—visualization and affirmations actually work. Your brain processes vividly imagined experiences almost like real ones. By focusing on what you want, instead of what you fear, you start setting yourself up for success without even realizing it.

5. Stop Overthinking, Start Doing

The best mindset in the world is useless without action. Coaching isn’t just about feeling good—it’s about taking consistent, meaningful steps toward your goals. It keeps you accountable, so you don’t fall into the “I’ll start tomorrow” trap.

Real-Life Wins from Coaching

Career Growth

A client who felt invisible at work used coaching to shift from “I’m not leadership material” to “I bring value.” Six months later? They landed a promotion and a pay bump.

Starting a Business

Someone who always wanted to start a business but feared failure finally took the plunge. Coaching helped them push past doubt, take calculated risks, and build something from the ground up.

Life, in General

From improving relationships to getting in shape, coaching helps people move from “I wish I could” to “I’m doing it.”

Where to Start If You Want to Shift Your Mindset

Not ready to dive into coaching? You can still start reshaping your mindset right now:

- Keep a journal. Write down limiting thoughts, then challenge them.

- Try mindfulness. A few minutes of meditation can help you recognize negative thought loops.

- Hang with people who think bigger. Your environment influences your mindset more than you realize.

- Invest in learning. Books, courses, or yes, a coach—whatever keeps you growing.

Final Takeaway

Success isn’t just about what you do—it’s about how you think. When you change your mindset, everything else follows. The best part? You’re in control of that change. So, what’s stopping you?

The Long-Term Benefits of a Growth Mindset

Shifting your mindset isn’t just about short-term wins—it’s about setting yourself up for lifelong success. When you develop a habit of challenging your own thoughts and pushing past self-imposed limits, you create a foundation for continuous growth. You stop fearing failure because you realize every setback is just another lesson, another step toward your bigger goals. Over time, this resilience and adaptability spill into every area of your life, making you more confident, capable, and unstoppable.

Why Accountability Makes All the Difference

Here’s the truth: even the most determined people struggle with follow-through. That’s why having an accountability system—whether it’s a coach, a mentor, or even a supportive friend—can be a game-changer. When you have someone who challenges you, keeps you on track, and reminds you why you started, your chances of success skyrocket. It’s not about having someone do the work for you; it’s about having someone who won’t let you settle for less than your potential.

The post How Coaching Can Rewire Your Mind for Success appeared first on Reliance Info.

]]>The post Investing in Aviator Gaming Industry ETFs appeared first on Reliance Info.

]]>What about Gaming Industry Growth?

The gaming industry has become so large. The market had 2.7 billion gamers, making its size $159.3 billion as of 2020; thus, surpassing revenues from the music and film industries together. This growth is contributed to by Aviator’s popularity, which attracts new players and maintains high levels of engagement.

Expanding Market Size and Revenue

Several factors contribute to the expanding market sizes and revenues in the gaming industry. This includes the growing number of gamers and increasing demand for gaming content. Aviator, with its unique risk-reward mechanics, which helps in driving player engagement and revenue.

Diverse Revenue Streams

The game industry has multiple income streams such as in-game purchases, subscriptions, advertising, and esports. The profitability of Aviator depends on its profits through in-game purchases and commissions, hence assuring a stable flow of revenues.

Esports: A Thriving Market

One thriving market within the gaming world is eSports which continues to positively affect it. The rapid growth of competitive gaming, its large viewer base, and significant revenue from tournaments highlight the investment potential.

The Impact of Technological Advancements

With technological advancements in place, the gaming profession is different now. Innovations like VR, AR, cloud gaming platforms etc., enhance the experience as well as expand the potential population that can play such games. Therefore, these advances can be used by Aviator to make their gameplay and reach.

Key Investment Strategies in the Gaming Industry

The gaming industry’s expansion offers several investment strategies for investors including Martingale, Paroli, d’Alembert and Labouchere.

- Martingale Strategy: Double the stake after every loss until a win occurs. That will recover all previous losses and make a profit. This strategy needs a large bankroll to work effectively, as it best suits persons with high-risk tolerance.

- Paroli Strategy: Doubling the bet after each win to maximize profits during winning streaks. It minimizes losses and is less dangerous than using Martingale.

- d’Alembert Strategy: Increasing the bet by one unit after a loss and reducing it by one unit after a win; thereby balancing risk while managing bankroll properly.

- Labouchere Strategy: A series of numbers representing the desired profit are made, thereafter summing up the first and last numbers you get. It helps to mitigate risks while achieving the intended profit.

- Strategy Calculators: Investor platforms contain different strategy calculators which help to optimize betting strategies leading to an improved outcome.

Strategy Calculators

Through investing in gaming industry ETFs, an investor can diversify his/her portfolio and have exposure to the gaming market without being exposed to idiosyncratic risks. Some of the benefits of ETFs include diversification, convenience and less risk than individual stocks.

Investing in Gaming Industry ETFs

The above is just one example of VanEckVectors Video Gaming and Esports ETF (ESPO) that comprises holdings located in leading game developers such as hardware, game development, and esports companies, thus providing a well-diversified portfolio with strong yields.

Case Study: Activision Blizzard

Activision Blizzard is a strategic investor in the gaming scene that is best known for its Call of Duty and World of Warcraft franchises. For instance, engaging in e-sports investments as well as adaptive marketing approaches have made it even more powerful in its sector, hence this illustrates how investing in games could be beneficial.

Factors to Consider When Investing

When investing several things must be considered including market trends, technological advancements, and the regulatory environment among others. The above details shape how the gaming industry is conceived, as well as how investment decisions end up being determined.

Market Trends and Regulations

Being aware of evolving market trends and new regulatory changes are a necessary precondition for making informed investment choices. By staying updated on these shifts within our industry, one can ensure that their investments correspond with future growth areas so that they do not get left behind by innovation and can adapt to new regulatory requirements.

Economic Factors

To make well-informed strategic decisions, investors should consider these factors when investing in the rapidly changing gaming sector.

Aviator Gaming Industry ETFs seem to be a good investment option for those seeking to exploit their potential. The dynamic nature of this market is supported by technological advancements and the increasing tastes of consumers, giving rise to the ground for creative games like Aviator.

The post Investing in Aviator Gaming Industry ETFs appeared first on Reliance Info.

]]>The post Insights from Foucault for Modern Business appeared first on Reliance Info.

]]>The Power of Classification

According to Michel Foucault, taxonomies are extremely important in making sense of the universe. In business, where information structuring significantly affects perceptions, this concept matters a lot.

The idea that power can be exercised through classifying and arranging data is at the heart of Foucault’s notion of classification and taxonomy. By controlling the way information is structured, developers can also control what other people see as reality. Businesses employ taxonomies when organizing their information strategically. For example, firms can categorize their products, services, or finances to highlight new opportunities or present themselves more favourably.

Concealing Weaknesses with Established Taxonomies

Many industries have adopted taxonomies to cover up their flaws. For example, Wall Street firms mix speculative trading gains with steady fees, and IT outsourcing companies utilize vague terms like “solutions” to look good.

Wall Street businesses typically blend the volatility of their trading incomes with stable revenue streams. On the other hand, IT outsourcing companies sometimes name their services under broad, unambiguous terms like “solutions.”. Moreover, this ambiguous language might conceal intricacy and potential risks from customers, making them more attractive to them.

Changing Perceptions: Bezos and Amazon

Smart executives such as Jeff Bezos comprehend the relevance of reclassification.

- In 2015, Amazon changed its focus by highlighting AWS, its profitable cloud-hosting business, thus shifting investor perceptions from a low-margin retail firm into a high-growth tech company.

- Amazon’s rebranding exercise was characterized by a prominent shift from being a traditional retailer to an organization powered by technology.

This reshuffling played an integral role in changing how investors saw it, leading to a significant rise in the value of Amazon on stock exchanges.

Uber and WeWork’s Strategic Reclassification

Amazon’s approach to designing the company’s corporate image and interacting with outsiders, who are encouraged, if not manipulated, to view them through certain lenses that emphasize their profitability as well as growth prospects, is adopted by both Uber and WeWork. It would be strategically useful for Uber to break down its operations based on city and vintage, since such a move allows for showing which areas are profitable and which ones are in the process of being exploited, thus making a meaningful picture of how strong it is performing.

Google’s Alphabet Shift

The restructuring into Alphabet was intended to make clear the scale of Google’s innovation efforts taking place within Google X and other parts of Google that are developing future-oriented technologies. The structure consists of two main segments: Google, which refers to core business operations, and “other bets,” meaning experimental projects. When broken down into Alphabet, there were essentially two divisions: one covering Google itself with all its basic activities like internet search, online advertising, Android operating system development, etc., and another group as “Other Bets,” where innovative endeavours previously known as X Labs now belong among others.

For instance, Waymo and Verily (formerly known as Google Life Sciences), among others, portray this commitment towards exploring new frontiers while maintaining the profitability of their core operations.

Alphabet’s Structure

| Division | Description | Key Projects |

| Core business operations include search, advertising, YouTube, Android, and Google Cloud. | Search, YouTube, Android, Google Cloud, and Google Maps | |

| Other Bets | Experimental and newer initiatives explore future technologies and industries. | Waymo (self-driving cars), Verily (life sciences), Loon (internet balloons), Wing (drone delivery), Calico (biotech) |

Digital Transformation at DBS Bank

DBS, a leading bank in Singapore, categorized its customers as “digital” or “traditional” to highlight its digital transformation. DBS tagged its customers based on their usage of digital products. By allocating costs between digital and traditional groups, DBS could showcase the efficiency and profitability of its digital transformation, significantly impacting the bank’s perception and stock performance.

Digital vs. Traditional Customers

By categorizing customers as digital or traditional, DBS demonstrated the financial benefits of its digital initiatives. Digital customers, often more profitable and cost-efficient, highlighted the bank’s successful shift towards a digital-first strategy.

The Limits of Reclassification

While reclassification can be powerful, it is not foolproof. Companies like GE and IBM have struggled despite efforts to classify parts of their business as high-tech, showing that performance ultimately matters. GE and IBM attempted to reclassify segments of their businesses to align with high-tech trends. However, their efforts were insufficient to offset underlying performance issues, demonstrating that reclassification alone cannot mask fundamental weaknesses.

Applying Foucault’s Business Lessons

Foucault’s insights into the power of taxonomies offer valuable lessons for businesses. Understanding and manipulating classifications can change perceptions and reality, but it requires skill and a clear vision. Businesses can learn from Foucault’s philosophy by strategically reclassifying information to influence perceptions and reveal new opportunities. However, this must be balanced with genuine performance improvements to ensure long-term success.

The post Insights from Foucault for Modern Business appeared first on Reliance Info.

]]>The post Unlocking Financial Success: A Comprehensive Guide to Wealth Management Services appeared first on Reliance Info.

]]>1. Wealth Management: A Detailed Exploration

At its core, wealth management is a comprehensive and integrated financial service aimed at optimizing an individual’s financial situation. Unlike traditional financial advisory services that may focus on specific areas, wealth management takes a holistic approach. It encompasses various crucial components such as investment management, financial planning, tax optimization, estate planning, and risk management. The goal is to create a tailored strategy that aligns with the client’s financial objectives.

| Service | Description |

| Investment Management | Strategic management of client investments for optimal returns. |

| Financial Planning | Holistic financial planning, aligning with client goals and objectives. |

| Tax Optimization | Strategies to optimize tax liabilities and enhance overall tax efficiency. |

| Estate Planning | Planning for the transfer of wealth, considering legal and tax implications. |

| Risk Management | Assessing and managing financial risks to protect and preserve wealth. |

2. Wealth Management Services, Financial Advisor Services or Family office

Wealth management services differ from traditional financial advisor services in their scope and focus. While financial advisors may specialize in specific areas like investment or retirement planning, wealth management services provide a broader, more integrated approach. Wealth managers work to understand the entirety of a client’s financial picture, considering various aspects simultaneously to create a cohesive strategy.

Alternatively, a family office approach can be used for wealth management purposes.

A family office serves as a dedicated entity to manage the comprehensive financial affairs of high-net-worth individuals and families. It plays a pivotal role in wealth management by offering personalized and holistic financial services, including investment management, tax planning, estate planning, and philanthropy. The family office’s primary objective is to preserve and grow the family’s wealth across generations, often tailoring strategies to the unique goals and values of the family.

Through sophisticated financial planning and investment strategies, family offices can optimize returns, mitigate risks, and ensure the long-term sustainability of the family’s wealth. Overall, the family office acts as a strategic partner, providing a centralized and professional approach to wealth management for affluent families.

3. Who Benefits from Wealth Management Services?

Determining whether you need wealth management services involves considering specific criteria. This service is particularly beneficial for high-net-worth individuals, business owners, and those with complex financial portfolios. If you find your financial situation involving intricate investment structures, diverse assets, and the need for comprehensive financial planning, wealth management services could be the key to unlocking your financial potential.

4. Understanding the Price of Wealth Management Services

The cost of wealth management services varies and is influenced by factors such as the complexity of financial portfolios, the scope of services provided, and the level of expertise offered by the wealth management firm. Typically, clients can expect to pay fees, commissions, or a combination of both. It’s crucial to understand the pricing structure and how it aligns with your financial goals.

| Fee Type | Description |

| Fixed Fees | Flat fee for specific services or a comprehensive plan. |

| Commission-based | Fees based on a percentage of assets under management. |

| Performance Fees | Fees tied to the performance of the investment portfolio. |

5. Crafting the Best Wealth Management Strategy: Key Points

Creating an effective wealth management strategy involves several key points:

- Set clear financial goals: Define short-term and long-term objectives.

- Regular portfolio reviews: Periodically assess and adjust your investment portfolio.

- Risk management: Understand your risk tolerance and incorporate risk management strategies into your plan.

- Adapt to life changes: Modify your strategy as your financial situation evolves.

Conclusion:

In conclusion, wealth management services provide a comprehensive and integrated approach to financial planning, offering individuals the tools to navigate the complexities of their financial landscapes successfully. By understanding the nuances of wealth management, comparing it to traditional financial advisory services, identifying its target audience, exploring examples, and understanding pricing, individuals can craft the best strategy to unlock their financial success. Remember, informed decision-making is the cornerstone of financial prosperity.

The post Unlocking Financial Success: A Comprehensive Guide to Wealth Management Services appeared first on Reliance Info.

]]>The post Driving Success: The Innovative Pathways in the Automotive Industry appeared first on Reliance Info.

]]>The Rise of Electric and Autonomous Vehicles

One of the most significant changes in recent years has been the increased adoption of electric and autonomous vehicles. Driven by concerns about climate change, air pollution, and dwindling fossil fuel reserves, many governments and consumers are embracing electric cars as a more sustainable alternative to traditional gasoline-powered vehicles.

- Battery technology advancements have made electric vehicles (EVs) more affordable and practical for everyday use, with longer ranges and faster charging times.

- Car manufacturers, including Tesla, Nissan, and Chevrolet, have introduced a variety of EV models that cater to different segments of the market.

- Autonomous vehicle technology is also progressing rapidly, with companies like Waymo, Cruise, and Argo AI testing self-driving cars on public roads.

As more and more electric and autonomous vehicles hit the streets, we can expect to see a significant reduction in greenhouse gas emissions and increased safety for all road users.

Digitalization and Connected Cars

Another major trend in the automotive industry is the digitalization and interconnectivity of vehicles. Modern cars are equipped with a range of sensors, cameras, and onboard computers that enable them to communicate with each other and with traffic infrastructure.

- Vehicle-to-Everything (V2X) communication allows cars to share information about their position, speed, and other data, enabling them to avoid collisions, optimize traffic flow, and reduce fuel consumption.

- Over-the-air (OTA) software updates ensure that vehicles remain up-to-date with the latest features and security patches, without requiring a visit to the dealership.

- Smartphone integration and advanced infotainment systems have become standard features in most new cars, providing drivers with easy access to navigation, entertainment, and communication services.

These advancements are making driving a more convenient, enjoyable, and safe experience for motorists and passengers alike.

E-Commerce and Online Car Shopping

The rise of e-commerce has not only transformed the way we shop for everyday items, but has also had a significant impact on the automotive industry. Online car shopping has become increasingly popular, as customers can now browse a wide range of new and used vehicles from the comfort of their own homes.

- Virtual showrooms and augmented reality apps allow prospective buyers to explore different models, colors, and configurations before making a decision.

- Many dealerships now offer online financing and trade-in valuations, streamlining the car-buying process and reducing the need for lengthy negotiations.

- Online car marketplaces, such as Zemotor, have emerged as a convenient platform for purchasing used cars, offering a vast selection of vehicles at competitive prices.

By embracing digital channels and offering a seamless online shopping experience, automotive businesses can better serve the needs of today’s tech-savvy consumers.

Shared Mobility and Transportation-as-a-Service

The concept of car ownership is being challenged by the growing popularity of shared mobility services and the emergence of Transportation-as-a-Service (TaaS) platforms. These innovative solutions provide on-demand access to vehicles without the costs and responsibilities associated with ownership.

- Ride-hailing services like Uber and Lyft have revolutionized the taxi industry, offering a more convenient and cost-effective alternative to traditional cabs.

- Car-sharing platforms, such as Zipcar and Turo, allow users to rent vehicles for short periods, making it easy for city dwellers to access a car when they need one.

- Subscription-based services like Volvo’s Care by Volvo and Audi’s Audi Select offer customers the option to pay a monthly fee for access to a range of vehicles, including insurance and maintenance costs, without the long-term commitment of ownership.

As urbanization and environmental concerns continue to grow, shared mobility and TaaS solutions are expected to become even more popular, leading to a shift in the way we think about transportation and personal mobility.

The Role of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) technologies are playing an increasingly important role in the automotive industry, helping to improve everything from vehicle design and manufacturing to customer service and marketing.

- AI-powered design tools can optimize vehicle aerodynamics, weight distribution, and crashworthiness, resulting in more efficient and safer vehicles.

- Machine learning algorithms can predict equipment failures and maintenance needs, enabling proactive servicing and reducing downtime.

- AI-driven marketing and sales strategies can personalize the customer experience, tailoring offers and recommendations based on individual preferences and driving habits.

By harnessing the power of AI and ML, automotive businesses can enhance their products and services, and gain a competitive edge in the rapidly-evolving market.

Conclusion

The automotive industry is undergoing a period of profound change and innovation, driven by advancements in technology, shifting consumer preferences, and a growing focus on sustainability. From the rise of electric and autonomous vehicles to the proliferation of digitalization and e-commerce platforms like Zemotor, the future of the automotive industry promises to be more efficient, eco-friendly, and customer-centric than ever before.

As we continue to explore the innovative pathways in the automotive world, it’s essential for industry players to adapt and embrace these changes to remain competitive and drive success in this dynamic landscape. Stay tuned to our blog for the latest insights and updates on the automotive industry, and join us on this exciting journey towards a smarter, greener, and more connected future of transportation.

The post Driving Success: The Innovative Pathways in the Automotive Industry appeared first on Reliance Info.

]]>The post Strategem Spectrum: Navigating the Business Battlefield with Tactical Ingenuity appeared first on Reliance Info.

]]>I. Fostering Innovation and Adaptability

In an age where disruption is the norm, businesses must be prepared to adapt and innovate to remain relevant. Here are some tactics for fostering a culture of ingenuity and adaptability:

1. Encourage Experimentation

- Provide a safe space for employees to test out new ideas and processes without fear of failure.

- Implement a system that rewards risk-taking and innovation.

2. Embrace Technological Advancements

- Stay up-to-date with the latest industry trends and technology.

- Invest in tools and software that can streamline processes and enhance productivity.

3. Cultivate a Learning Environment

- Offer ongoing training and professional development opportunities.

- Encourage cross-functional collaboration to promote knowledge sharing and creative problem-solving.

II. Mastering the Art of Negotiation

In the business world, effective negotiation skills are essential for securing deals and fostering partnerships. Consider these strategies for mastering the art of negotiation:

1. Do Your Homework

- Research the other party’s needs, goals, and pain points.

- Develop a thorough understanding of your own company’s strengths and weaknesses.

2. Establish Rapport

- Build a connection with the other party through active listening and empathy.

- Display confidence and professionalism while remaining approachable.

3. Be Prepared to Compromise

- Identify areas where both parties can find common ground.

- Be willing to make concessions in order to reach a mutually beneficial agreement.

III. Harnessing the Power of Networking

Building a strong network of connections can open doors to new opportunities and accelerate business growth. Here are some networking tactics to consider:

1. Attend Industry Events

- Participate in conferences, trade shows, and networking events to connect with potential partners and clients.

- Use social media platforms to share your expertise and engage with industry influencers.

2. Cultivate Strategic Alliances

- Identify complementary businesses and explore opportunities for collaboration.

- Leverage joint ventures and partnerships to expand your reach and access new markets.

3. Offer Value to Your Network

- Share valuable insights and resources with your connections.

- Provide assistance and support when others in your network need it.

IV. Implementing Effective Marketing Strategies

A well-executed marketing plan can propel your business to new heights. Consider these marketing strategies for maximum impact:

1. Develop a Strong Brand Identity

- Create a unique and memorable brand that resonates with your target audience.

- Ensure consistency across all marketing channels, from your website to social media profiles.

2. Leverage Content Marketing

- Produce high-quality, engaging content that showcases your expertise and addresses your audience’s pain points.

- Utilize a variety of content formats, such as blog posts, videos, and infographics.

3. Optimize for Search Engines

- Conduct thorough keyword research to identify high-volume, relevant terms.

- Implement on-page and off-page SEO best practices to improve your website’s visibility in search engine results.

V. Streamlining Operations and Boosting Efficiency

A well-oiled machine runs smoothly and efficiently. Apply these tactics to streamline your business operations and enhance overall efficiency:

1. Analyze and Optimize Processes

- Regularly review and assess your business processes to identify areas for improvement.

- Implement automation tools and software to eliminate manual tasks and increase efficiency.

2. Embrace Data-Driven Decision Making

- Collect and analyze data to make informed decisions about business operations and strategies.

- Utilize tools like data visualization and predictive analytics to uncover trends and patterns.

3. Prioritize Effective Communication

- Implement communication tools and platforms that facilitate seamless collaboration among team members.

- Encourage transparency and open dialogue to prevent misunderstandings and promote a cohesive work environment.

VI. Nurturing a Positive Company Culture

A positive company culture can boost employee satisfaction, productivity, and retention. Here are some tactics to foster a thriving work environment:

1. Promote Work-Life Balance

- Encourage employees to maintain a healthy balance between their professional and personal lives.

- Offer flexible work arrangements, such as remote work and flextime, to accommodate different needs and preferences.

2. Recognize and Reward Achievements

- Acknowledge individual and team accomplishments with public praise or tangible rewards.

- Implement a structured employee recognition program to celebrate milestones and exceptional performance.

3. Foster Inclusivity and Diversity

- Cultivate a diverse and inclusive workplace by embracing different perspectives and backgrounds.

- Offer training and resources to promote understanding and empathy among team members.

In conclusion, navigating the business battlefield requires a combination of tactical ingenuity, adaptability, and perseverance. By fostering innovation, mastering negotiation, leveraging networking, implementing effective marketing strategies, streamlining operations, and nurturing a positive company culture, your business can not only survive but also thrive in today’s competitive landscape. Remember to stay agile and open to change, as the only constant in business is change itself.

The post Strategem Spectrum: Navigating the Business Battlefield with Tactical Ingenuity appeared first on Reliance Info.

]]>The post How to Decide Which Business to Launch appeared first on Reliance Info.

]]>Discover Your Interests and Passions

The first step in selecting the ideal business is to identify your interests and passions. Reflect on the activities, hobbies, or subjects that genuinely excite and inspire you. Launching a business in a field you are passionate about makes the journey more enjoyable and helps maintain motivation during challenging times. Remember, your passion and enthusiasm can be infectious, attracting customers, partners, and investors alike.

Assess Your Skills and Expertise

Take stock of your skills, knowledge, and expertise to determine the type of business best suited to your strengths. Consider your professional experience, education, and innate talents. Aligning your business with your skills increases the likelihood of success and enables you to tackle challenges more effectively. Additionally, identify any areas where you may lack skills and consider addressing these gaps through training, collaboration, or hiring.

Investigate Market Demand and Trends

Examine market demand and trends to ensure your chosen business has the potential for growth and profitability. Identify both existing and emerging industries, as well as any market gaps your business could address. A solid understanding of the market landscape allows you to make strategic decisions and position your business for success. Keep abreast of industry developments and be prepared to adapt your business to capitalize on evolving circumstances and opportunities.

Evaluate Your Financial Resources

Starting a business requires financial investment, so it’s crucial to assess your available capital and decide how much you’re willing to invest. Take into account the startup costs, ongoing expenses, and potential revenue of various business options. Select a business that aligns with your financial situation and offers a viable path to profitability. Careful financial planning and realistic expectations can help prevent future financial strain.

Assess Your Time Commitment

Launching and managing a business demands a significant time investment. Be realistic about the amount of time you can dedicate to your new venture, taking into account your current job, family, and personal commitments. Opt for a business that aligns with your schedule and allows for a healthy work-life balance. Effective time management and organization are essential skills for a successful entrepreneur, so be prepared to prioritize tasks and set boundaries.

Identify Your Target Market

Gain a clear understanding of your potential customers, including their needs, preferences, and challenges. This knowledge allows you to tailor your products or services to meet customer demands, making your business more attractive and increasing your likelihood of success. Develop customer personas and conduct market research to gain valuable insights into your target market’s preferences and behaviors.

Examine Business Models and Structures

Explore various business models and structures to identify the best fit for your chosen industry and personal preferences. Factors such as scalability, flexibility, and legal requirements should be considered when selecting the appropriate model for your business. Familiarize yourself with different legal structures, such as sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. The right business model and structure can significantly impact your company’s growth potential, tax implications, and liability.

Consult Mentors and Industry Professionals

Seek guidance from experienced entrepreneurs, mentors, and industry professionals. Their insights, advice, and experiences can help inform your decisions, avoid common pitfalls, and boost your chances of success. Networking and forging relationships with industry experts can also lead to valuable partnerships and collaborations.

In Conclusion

Deciding which business to start is a crucial decision with long-lasting consequences. By carefully weighing your passions, skills, market demand, resources, and target audience, you can make an informed choice that sets you on the path to success. Remember to explore different business models and structures, and seek advice from experienced professionals to help guide your decision-making process. Ultimately, the right business for you will align with your personal and professional goals, allowing you to grow and thrive as an entrepreneur. With careful planning and dedication, you can turn your dream of starting a business into a reality.

Choosing the right business to launch is a critical decision that requires thorough research, introspection, and planning. By following the steps outlined in this article, you will be better prepared to make a well-informed decision, setting yourself up for success in your entrepreneurial journey. Keep in mind that persistence and adaptability are essential qualities for any entrepreneur. Embrace challenges as opportunities for growth, and always be open to learning and evolving along the way.

The post How to Decide Which Business to Launch appeared first on Reliance Info.

]]>The post How to Find Investors for Small Business appeared first on Reliance Info.

]]>Develop a Solid Business Plan

The foundation for attracting investors is a comprehensive business plan. Your plan should encompass an overview of your business, market analysis, in-depth product or service descriptions, financial projections, and marketing strategies. Additionally, it should emphasize your business’s unique selling points and competitive advantages. A robust business plan not only enhances your understanding of your business but also demonstrates your dedication and preparedness for success to potential investors.

Identify Potential Investors

Before pitching your business, it’s crucial to pinpoint potential investors who may have an interest in your industry or business model. Investigate venture capitalists, angel investors, or even friends and family members who might be willing to invest. Also you can make your money work for you with the Citi Double Cash Card. This amazing offer gives you cash back on every purchase, plus an invitation code to take advantage of even more rewards.

Network and Attend Industry Events

Networking is crucial when searching for investors. Attend industry events, conferences, and trade shows to meet potential investors and other business owners in your field. Building relationships within your industry can lead to valuable introductions and help you learn about new investment opportunities. Make sure to have your elevator pitch ready and leave a lasting impression on everyone you meet. In addition to traditional events, consider joining online forums, social media groups, and professional associations to expand your network and increase your chances of meeting the right investors.

Craft a Compelling Pitch

Once you’ve identified potential investors and built a network, it’s time to craft a compelling pitch. Your pitch should be concise, engaging, and showcase the potential of your business. It should highlight the problem your business solves, how your product or service stands out from competitors, and the financial projections that demonstrate your potential for growth and profitability. Consider practicing your pitch with friends, family, or mentors to receive constructive feedback and refine your presentation. Additionally, be prepared to tailor your pitch to different investors, as each may have unique interests and concerns.

Leverage Online Platforms and Crowdfunding

Online platforms and crowdfunding sites can be excellent resources for finding investors. Platforms like Kickstarter, Indiegogo, and CircleUp allow you to showcase your business idea, raise funds, and reach a broader audience of potential investors. Ensure your crowdfunding campaign is well-planned and includes a compelling pitch, attractive rewards for backers, and a clear explanation of how the funds will be used. You can also consider equity crowdfunding platforms, such as SeedInvest and WeFunder, which enable you to sell shares of your company to accredited investors. By leveraging these online resources, you can increase your visibility and attract a diverse group of investors who share your vision and believe in your business.

Prepare for Due Diligence

When potential investors express interest, be ready for them to conduct due diligence. This process involves a thorough examination of your business, including financials, legal documents, market analysis, and management team. Be organized, transparent, and proactive in providing all required information and addressing any questions they may have. Demonstrating that your records are current, accurate, and easily understood will convey your professionalism and commitment to your business’s success, building trust with potential investors and increasing the likelihood of securing investment.

Maintain Strong Communication

Fostering and maintaining open communication with your investors is critical for a successful partnership. Keep them informed about your business’s progress, challenges encountered, and how their investment is being utilized. Establishing trust and demonstrating your dedication to the business will promote a positive relationship with your investors and increase the likelihood of their continued support. Be transparent and responsive, ensuring that you provide regular updates, promptly respond to inquiries, and remain open to feedback and advice from your investors. By nurturing these relationships, you’ll not only secure the funding you need but also gain valuable insights and guidance that can help your business grow and succeed.

Conclusion

Locating investors for your small business is a critical step in obtaining the funding necessary for growth and success. By developing a solid business plan, identifying potential investors, networking, crafting a compelling pitch, and leveraging online resources, you can improve your chances of attracting the right investors for your business. Remember to prepare for due diligence, maintain strong communication with your investors, and explore all available funding options. With determination and persistence, you’ll be well on your way to securing the investment your small business needs to thrive.

The post How to Find Investors for Small Business appeared first on Reliance Info.

]]>The post How to start an online gambling business in Canada appeared first on Reliance Info.

]]>Regardless of which type of gambling you choose, to start an online project you will need to go through the following stages.

Market and target audience analysis

In spite of the fact that users from all over the world can access the gambling site, projects designed for a certain audience are more successful. You can learn about the current state of the market and the forecasts for the nearest future in the corresponding section of our website.

To get more detailed information about particular geographical, social or other segment marketing and consulting agencies will help. For example, we offer you to get acquainted with the analytics of gambling apps on AppStore and Google Play.

Before you start a startup, we recommend that you check out the great reviews of Canadian gambling sites on Best Online Casino Websites in Canada, so you’ll have a good example to draw inspiration from.

Getting a license

The gambling industry is under the watchful eye of government agencies. But not all countries have a clear and reliable regulatory mechanism. This situation is exploited by small states, such as the Isle of Man or Curacao. They promise interesting licensing conditions that sometimes allow operating in other jurisdictions.

Here is a look at the most popular gambling jurisdictions and a brief evaluation of the state regulators in these regions.

It is very difficult to do without a license. Firstly, popular payment systems will refuse to cooperate with the casino, operating without a license. Secondly, the license is a guarantee of honesty and transparency of the institution, which players pay attention to in the first place. However, there is a way to bypass the need for a license – for example, you can open an online casino White Label.

How to open an online casino in Canada?

The license is received. What to do next? Before you create a casino online in a certain direction, you need to take care of funds for the purchase of software. Software for the casino is the largest part of the investment in your own business. On their basis and is based on the work of an online gambling house

There are several manufacturers on the software market – both world-renowned and more modest. If you order the program from the developers belonging to the premium-class segment, you can open an online casino, investing not less than one million dollars.

Ordering programs from brands more modestly will cost several hundred thousand dollars. Very low-budget no-knowledge software payback casinos can not bring – despite the fact that their value is also thousands of dollars.

Official software developers advise how to open an online casino as safely as possible. For a 20% royalty they will protect the site or application from hacking, from the overload due to the huge number of visitors. And do not let the word “royalty” scare you – practice shows that the elimination of such problems by their own forces is much more expensive.

Buying a domain name

These days, though, users very rarely type in a website address by hand. But the domain name is an important part of branding, so the future of the project depends on the right choice of site address.

Renting or buying a hosting server

Online casinos, like any other major project, are very demanding to the quality of hosting. It is necessary to ensure high bandwidth, security from hacker attacks and reliable operation of the resource.

Some gambling platform providers offer clients not only the software, but also their own site to host the site.

Develop a branded interface design

High competition in the market of online gambling requires a serious approach to the visual design of sites and user-friendly interface.

Of course, there is a category of players who are interested only in the financial component – they count bonuses, promotions and their own winnings, not paying attention to everything else. But if you want to attract customers not only with generous monetary rewards, you should think about the original design.

Modern targeting technology allows you to automatically determine many parameters of each visitor and direct him to the appropriate page. This makes it possible, within one project, to use several design options, interface languages and other site elements at once.

Organization of an online casino

Unlike most other Internet projects, the gambling site has higher requirements. Therefore, the use of popular “engines” here will not help – almost all online casinos are developed as individual projects.

Platform providers offer ready-made solutions. Buying a platform, you get a ready-made system on which you can deploy a casino, a bookmaker’s office or a bingo club.

Platform Integration

The platform is the foundation that unites the products of different studios (games, betting lines), payment systems, internal services and security systems into one. Therefore, the choice of platform is a key decision when creating a gambling project.

Using several platforms from different providers at the same time is an extremely technically complicated and expensive solution. In most cases it is easier to launch a new site than to change suppliers or add another one. Therefore, the “marriage” between the operator of a gambling project and the platform provider is concluded for many years.

Game integration from popular providers

Modern online gambling is a complex and expensive software product. Not only programmers, but also mathematicians, psychologists, designers and artists are working on their creation. Most popular platforms allow you to integrate games from several studios.

Offshore for Canadian Casino Online

New technologies have made it possible to expand entertainment opportunities and created new business areas, such as online casinos, online games, sweepstakes and other gambling and entertainment. As for any business activity gambling business needs proper protection and favorable conditions of tax burden optimization. Offshore for internet casinos is a very attractive option, as onshore jurisdictions have very strict legislations concerning this business activity.

The most prominent jurisdictions that are willing to establish an offshore for an online casino offer jurisdictions and territories, among them: Costa Rica, Malta, Gibraltar, Nevis, UK, Curacao, Cyprus, Isle of Man, Seychelles, Alderney and so on. Besides offshore, there are plenty of other jurisdictions willing to issue a license for Internet gambling, among them: France, Australia, Czech Republic, Kanawake, New Zealand, BVI, Cagayan Economic Zone and Free Port, Denmark, Kazakhstan, Antigua and Barbuda, Western Cape, New York, Germany, Belize, Northern Territories, Vanuatu, Montenegro, USA, Guernsey, Spain, Greece, Panama, Swaziland, Bosnia and New South Wales, Estonia, Lithuania, Aland Islands, Mauritius, Austria, Schleswig-Holstein, Uruguay, Marshall Islands, Ireland, Japan, Anguilla, Romania, Bulgaria, Hungary, Latvia, Netherlands, Poland, Portugal, Slovenia, Sweden, Turkey, Belgium, Slovakia, Victoria, Philippines.

The most popular of the above jurisdictions for offshore registration for online casinos are: Costa Rica, Malta, Gibraltar, Nevis, Alderney (UK), Guernsey (UK), Curacao, UK, Macau (China), Kanawake (Canada).

Obtaining a license for online casinos in Europe requires a significant financial investment, as well as an annual audit and other requirements. While getting a gambling license in Asia is a bit more affordable.

The same applies to gambling licenses in Caribbean jurisdictions. It is much easier to get an online casino license in the Caribbean. For example, the cost of a license in Curacao will cost you about C$10,000. In addition, the Caribbean countries offer low taxation, not more than a few percent.

Offshore in Seychelles

Seychelles offers the possibility of obtaining a gambling license by obtaining a Special Company License (CSL: Company with Special License). These companies conduct any activity which is approved by the Ministry of Finance, including gambling. Companies are not anonymous and pay tax at a rate of 1.5%.

For Seychelles companies and licenses must be audited, but as a rule, these checks are very simple.

Offshore in Cagayan de toro

In the north of the Philippines there is the Cagayan Special Economic Zone, which is a partially autonomous region where gambling is a legal activity, and licenses are granted for Internet casinos. In fact, it is against Philippine law, but in reality nothing is done about it.

There are casinos that have been licensed here, and the process of obtaining this license was quite easy and at affordable prices.

Offshore in Nevis

Under the Betting and Gaming Administration Act of 1999, the Federation of St. Kitts and Nevis provides the opportunity to obtain a license for gambling. Local residents of the island are not allowed to play at online casinos.

In order to obtain an online casino license in St. Kitts and Nevis, you must establish a company in the jurisdiction, apply for a license, and meet all necessary requirements.

According to government regulations, a company cannot have the word “Casino” in its name. The state fee to obtain a license is $80,000, and the annual renewal is $40,000. A written statement that no Federation citizens will be allowed to wager or perform other gaming activities is required. A work permit is required for all non-citizens.

Notification of changes in directors or beneficial owners of the company must be submitted to the appropriate government agency. Ads posted on the Internet must be verified by government agencies. Company must have a bank account with a bank in St. Kitts and Nevis.

Offshore in Gibraltar

Gibraltar is a self-governing jurisdiction, which is dependent on the British Crown. The country is a full member of the EU, and is completely independent of British legislation. Gibraltar is well known as a center of online gambling, as in 2013, 25 companies in the field of online casinos and games were established in the tiny country, which were able to employ about 2 thousand workers.

Many gambling participants consider Gibraltar one of the best places to establish a company and get the necessary license.

Gibraltar began issuing licenses for online casinos back in 1998. State authorities offer the possibility of obtaining a license: betting license, license for intermediaries to place bets, gambling operators license, license for slot machines, lotteries, for promoters and online games.

Licenses are only issued to operators with a proven track record, who are already licensed in reputable jurisdictions and have a good financial standing and a realistic business plan. Software testing is part of the process.

The tax on income from online gambling activities is 1%. Currency exchange for betting is also taxed at the same rates as other transactions. For online casinos, the gaming tax is 1% of gross profit. There is no VAT tax in Gibraltar.

In June 2014, the Gibraltar Gambling and Betting Association (GBGA), which represents operators based in Gibraltar, ran into difficulties because of potential amendments to the Gambling Act, which could require the UK Gambling Commission to apply for a license. GBGA’s argument was that since Gibraltar operators are already licensed in Gibraltar, they do not need a license in the UK and should not be subject to the 15% UK consumer tax. The resolution of the GBGA’s legal challenge has not yet been determined.

Offshore in Costa Rica

Many people choose Costa Rica because of the ease and speed of registering an offshore company, and further obtaining the necessary license. Offshore Costa Rica is located in Central America, between Panama and Nicaragua. The main advantage of this jurisdiction is the principle of territorial taxation, the same as in Hong Kong. In fact, if your company in Costa Rica conducts business activities and manages abroad, it is tax exempt. However, income earned inside Costa Rica is taxed up to 25%, but if you are officially employed here, taxes will not rise above 15%.

In order to open an offshore internet casino in Costa Rica, you need to initially block all IP addresses from Costa Rica, get a data processing license as well as special company statutes. For legal reasons, we recommend that you install physical servers in Costa Rica. Also among the Costa Rican requirements for obtaining and maintaining a license is the need for a physical presence in Costa Rica in the form of an office or employee. We provide this service.

It takes 1-2 months to register offshore for an online casino in Costa Rica and another 6 months to obtain a license. You can speed up the process by purchasing a ready-made offshore site through us. We can also help with the selection of an offshore account to start your online casino.

Costs for registration of a company with a gambling license in Costa Rica.

Offshore in Malta

Another option is to open a company and obtain a license for online casinos in Malta. Malta is a member of the EU, which gives the country political and financial stability, and accordingly the prestige of all companies established in Malta, including offshore for online casinos.

In Malta, you will be able to establish not just an offshore but a European company with attractive taxes. In addition, you will be able to open an account in a Maltese bank with no restrictions on your business. A Maltese company will lend prestige to your business as well as provide you with the possibility of obtaining a residence permit in Malta.

The taxation system for online casinos in Malta is the same as for Maltese trading companies. The corporate tax rate is 5-6%.

After opening an account in Malta, your offshore online casino will be able to connect directly to the merchant account for processing credit cards over the Internet.

Offshore internet casinos in Malta will be much more expensive than in one of the Caribbean countries, but it is much easier to open a bank account for the Maltese company. That is why it is important to find a bank that will cooperate with the Costa Rican online casino.

Gambling license in Costa Rica

If a company needs to obtain a license, it is worth adding the following costs. Application for a license to operate an internet gambling site. Data processing licenses, these are licenses for gambling operations that operate in Costa Rica. All Costa Rican IP addresses must be blocked from accessing the site.

Offshore payments for online casinos

The choice is quite limited if you are setting up a company with a small capital. Finding an offshore bank for online casinos is as difficult as for e-wallets and cryptocurrencies (Liberty Reserve, Pecunix, PerfectMoney, SolidTrustPay, BitCoins).

If you are planning to establish a serious online casino startup, but cannot establish a company in one of the respectable jurisdictions, it is worth visiting all kinds of conferences and establishing connections just with the payment system providers. A good personal relationship will defeat the policy of a company that does not accept merchants of a certain direction.

Integration of payment systems

Convenience of deposit and withdrawal is one of the most important criteria by which users choose a site for gambling. It is desirable to connect to the site all the payment systems used by representatives of its target audience.

Some platforms already have ready-made solutions, with input and output systems connected. But in most cases, the owner of the resource needs to negotiate with payment providers himself. Some systems require an impressive package of documents, others are satisfied with only a gambling license.

Using bitcoin in online casinos

Another tool for gambling profits is bitcoin – a currency that opens up great opportunities in online gambling. For more information, see the webinar “Bitcoin Casino as a tool to profit” from the company CASEXE.

Integrate a reliable security system

The hunt for bonuses provided by online casinos for the first deposit has already become a popular type of online earning. Modern security systems allow not only tracking cheaters, but also obtaining a large amount of information about all visitors to the site.

The security system can be integrated into the platform or come separately.

Creating related sites

Gamblers live not only by the game, they like to share their experience, discuss slots and simply communicate. That is why it makes sense to create several side-projects, which will increase involvement and help to keep regular customers. At a minimum, you should think about creating a forum and a blog.

Some operators go even further – to create social casinos on separate sites (sites offering “play for free”) to attract new customers.

Social media work

Having your own communities or pages in popular social networks has already become the rule of etiquette. Moreover, regular posting of posts on behalf of the administration of the gambling establishment helps to create a positive reputation for the online casino.

The work on the image and reputation should be started as early as possible, social networks are a great platform for such activities.

Working with affiliate programs

The easiest and fastest way to attract customers to a new online casino is to use affiliate programs. But not all programs give the same result, some of them will ask too much money even for the player who has placed the minimum deposit. The right choice of partners and building relationships with them largely depends on the success of the project.

Other types of Internet marketing

A gambling site is just as much an online project as an online store, a news resource or an entertainment portal. The same technology works as in other e-commerce sectors. Even the major search engines allow you to place contextual advertising online casinos, but under certain conditions.

“Promotion” gambling project is different from the promotion of an ordinary website. There are secrets and tricks that can reduce costs and improve the effectiveness of advertising.

Ground advertising

The volume of developed Western markets, such as the UK or Italy, is many times greater than in Eastern Europe or Latin America. But competition in these markets is also very high. Young and aggressive operators are fighting for clients not only online, but also offline. Of course, this kind of advertising is expensive, but with the right approach, the effectiveness justifies the money invested.

Creating a customer service desk

Gamblers, at the very least, want to enjoy the game itself. Unfortunately, even the best software sometimes fails. A player may not understand a nuance of the interface or encounter problems with the payment system. That is why a gambling site cannot do without friendly and reliable support service. The speed of problem solving is one of the most important indicators of the quality of the site.

Working with high rollers

Online casinos, like land-based establishments, receive most of their revenue from high-rollers – players who place large bets. Such a gambler can leave more money in one session than a thousand small customers. High-rollers know their worth, so they require special treatment. If a casino knows how to please high rollers, it has only a bright future ahead of it.

Working with loyal customers

The player makes a deposit, then plays for a while, then he runs out of money. In upset feelings he leaves the online casino. But if the administration of the institution manages to influence his mood, the player is sure to return.

Attracting a customer in the online gambling industry can be very expensive, but not all players create large deposits. Therefore, in order for the establishment to be successful, you need to constantly work to increase player activity and encourage them to return to the site on a regular basis.

Now you know how to open an online casino or betting company on the Internet.

The post How to start an online gambling business in Canada appeared first on Reliance Info.

]]>