The financial technology (FinTech) sector is rapidly evolving, driven by technological advancements and the increasing adoption of digital currencies. Within this ever-expanding landscape, stablecoins have emerged as a vital tool for enhancing the stability and efficiency of financial systems. These digital assets, which are designed to maintain a stable value, have gained significant traction, especially among businesses and consumers who seek alternatives to volatile cryptocurrencies. Among the most prominent stablecoins is USDC (USD Coin), a fiat-collateralized digital asset that has garnered widespread use across various industries, including online gambling.

This article explores the growing significance of stablecoins, particularly USDC, in the FinTech landscape. We will delve into the current trends in financial technologies, examine the role of stablecoins in digital transactions, and highlight how USDC is transforming industries like online payments and gambling.

Current Trends in Financial Technologies

Digital Transformation in Banking and Payments

Over the past decade, the financial services industry has witnessed a massive digital transformation. Traditional banks and payment providers have embraced new technologies to streamline operations, reduce costs, and improve customer experiences. The rise of digital wallets, mobile banking apps, and instant payments has revolutionized the way individuals and businesses conduct transactions. Digital transformation has made financial systems more accessible and efficient, facilitating faster and more secure interactions.

Blockchain and Distributed Ledger Technologies

At the heart of this transformation is blockchain technology, a decentralized and immutable ledger system that underpins cryptocurrencies and stablecoins. Blockchain offers numerous benefits, such as increased transparency, lower transaction costs, and enhanced security. Distributed ledger technology (DLT) has opened up new possibilities for financial systems, allowing for more efficient cross-border transactions, better record-keeping, and the elimination of intermediaries. These advancements have positioned blockchain as a cornerstone of modern financial technologies.

Regulatory Evolution and Compliance Standards

As the FinTech sector continues to grow, regulators have been working to establish frameworks that ensure the safety, security, and fairness of digital financial systems. Governments around the world are introducing new regulations to address the challenges posed by digital currencies, including anti-money laundering (AML) and know-your-customer (KYC) standards. These regulatory efforts aim to create a balance between fostering innovation and protecting users, ensuring that the financial ecosystem remains stable and trustworthy.

Understanding Stablecoins

Definition and Types (Algorithmic vs. Fiat-Collateralized)

Stablecoins are a class of cryptocurrencies that aim to maintain a stable value by pegging their worth to a reserve asset, such as a fiat currency or a commodity. There are two main types of stablecoins: algorithmic and fiat-collateralized. Algorithmic stablecoins use algorithms to control supply and demand, while fiat-collateralized stablecoins are backed by reserves of fiat currency, such as the US dollar.

USDC, for example, is a fiat-collateralized stablecoin, meaning it is backed by a reserve of US dollars. This provides users with a reliable and transparent store of value, making it ideal for use in financial transactions.

Market Dynamics and Adoption Rates

The adoption of stablecoins has surged in recent years, with billions of dollars’ worth of stablecoins circulating in the market. USDC has emerged as one of the most popular stablecoins, with a growing number of businesses integrating it into their payment systems. Stablecoins offer advantages such as lower volatility, faster transaction speeds, and greater security, which have contributed to their rapid adoption.

Comparative Analysis: USDC vs. Other Stablecoins (e.g., Tether, DAI)

USDC stands out from other stablecoins like Tether (USDT) and DAI due to its transparency and regulatory compliance. USDC is issued by Circle, a regulated financial institution, and is subject to regular audits to ensure that each USDC token is backed by an equivalent amount of US dollars. This transparency makes USDC a more trusted option for businesses and individuals who value stability and regulatory oversight.

In contrast, Tether has faced scrutiny over its reserves and transparency, while DAI is a decentralized stablecoin that relies on smart contracts and collateralized assets to maintain its value.

Underlying Technology and Security Protocols

USDC operates on multiple blockchains, including Ethereum, Solana, and Algorand, using the ERC-20 standard for Ethereum. This allows USDC to be easily integrated into existing blockchain networks and enables users to transact across different platforms seamlessly. Additionally, USDC uses strong security protocols, such as multi-signature wallets and cryptographic hashing, to ensure the safety of users’ funds.

USDC: A Detailed Examination

Issuance, Backing, and Transparency

USDC is issued by Circle, a financial technology company that has partnered with Coinbase to form the Centre consortium. Each USDC token is fully backed by a reserve of US dollars, held in regulated financial institutions. This backing ensures that users can redeem USDC at any time for US dollars, providing stability and trust in the asset. Circle publishes regular reports to confirm the backing of USDC, offering transparency that is crucial for businesses and consumers. You can explore more about USDC’s growth and its impact on the digital economy through the State of the USDC Economy report here.

Integration with Traditional and Digital Financial Systems

USDC is designed to integrate seamlessly with both traditional and digital financial systems. It can be used for a wide range of applications, including remittances, cross-border payments, and online gambling. By bridging the gap between traditional finance and blockchain technology, USDC has become a key player in the growing world of digital currencies.

Advantages for Cross-Border Transactions and Financial Inclusion

One of the key benefits of USDC is its ability to facilitate fast, low-cost cross-border transactions. Traditional remittance systems can be slow and expensive, with high fees and long processing times. USDC, on the other hand, allows for near-instantaneous transactions at a fraction of the cost, making it an attractive option for individuals and businesses involved in international trade.

Additionally, USDC has the potential to promote financial inclusion by providing access to digital financial services for individuals in underserved regions. With stablecoins like USDC, people who lack access to traditional banking systems can participate in the global economy and engage in secure, low-cost financial transactions.

Role in Mitigating Volatility in Crypto Markets

One of the main challenges of cryptocurrencies like Bitcoin and Ethereum is their volatility. Prices can fluctuate wildly, making them unsuitable for everyday transactions. USDC mitigates this issue by maintaining a stable value, pegged to the US dollar. This stability makes USDC a more reliable choice for businesses and individuals who want to use digital currencies without worrying about price swings.

USDC in Online Payment Systems

Digital payments have revolutionized industries like e-commerce, online gambling, and gaming. In high-stakes industries, where large transactions occur regularly, speed and security are crucial. Traditional payment methods can be slow and costly, leading to frustration for both businesses and customers. Stablecoins like USDC offer a solution by enabling faster and more secure transactions, improving the overall user experience.

Security, Speed, and Efficiency in Transaction Processing

USDC offers several advantages over traditional payment methods. Transactions involving USDC are processed almost instantly, reducing the time it takes for funds to be transferred between parties. Furthermore, USDC transactions are secure, with blockchain technology providing an immutable and transparent record of every transaction. This eliminates the need for intermediaries, which can introduce delays and additional costs.

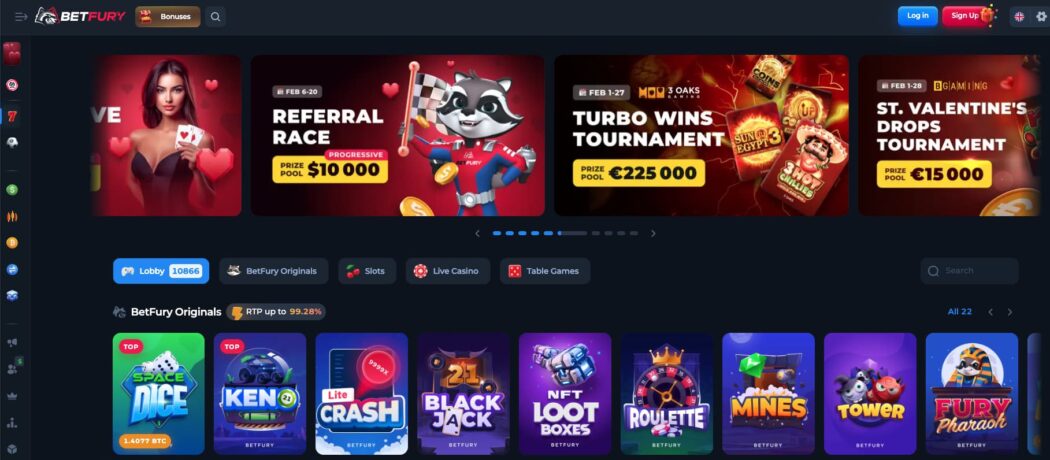

BetFury USDC Casino: A Case Study

BetFury implemented USDC as a stablecoin payment option to provide its players with faster and more secure transactions, minimizing the volatility commonly associated with traditional cryptocurrencies. By integrating USDC, the platform enhanced the user experience, offering quicker deposits and withdrawals compared to conventional payment methods. This move also catered to players seeking stability in their transactions, especially in high-stakes gambling. Alongside USDC, BetFury continues to support a wide range of other cryptocurrencies, giving users more flexibility while ensuring seamless interaction within the crypto ecosystem. The platform’s technical integration allowed for smooth scalability, positioning BetFury to expand its crypto offerings further in the future. More details about how USDC enhances the gambling experience can be found on BetFury’s dedicated USDC Casino page: https://betfury.com/casino/usdc.

Integration Process and Technical Architecture

The integration of USDC into BetFury’s platform was a seamless process, leveraging existing blockchain infrastructure and wallet systems. By incorporating USDC, BetFury was able to offer its players a faster and more secure payment method while minimizing the risks associated with volatility. The platform’s backend systems were designed to handle USDC transactions with high efficiency, ensuring smooth operations even during periods of high demand.

User Experience Improvements and Transaction Efficiency

By adopting USDC, BetFury improved the overall user experience by reducing the time it takes for deposits and withdrawals. Players no longer had to wait for long processing times or worry about fluctuations in cryptocurrency values. This enhanced efficiency not only increased player satisfaction but also helped BetFury attract a broader audience of crypto enthusiasts.

Comparative Benefits over Traditional Payment Methods

USDC offers several key advantages over traditional payment methods. Unlike credit cards or bank transfers, USDC transactions are processed quickly and at a lower cost. Furthermore, USDC’s stability eliminates the risk of price fluctuations, making it a more reliable option for players who want to avoid the volatility of traditional cryptocurrencies.

Scalability and Future Prospects in Online Gambling

As BetFury continues to grow, the integration of USDC positions the platform for future expansion. The scalability of blockchain technology ensures that BetFury can continue to offer a wide range of payment options, including USDC, as the demand for digital currencies in online gambling increases. BetFury’s commitment to innovation and technological advancement ensures that it will remain a leading player in the online gambling space.

Broader Impact on the Business Ecosystem

Enhancing Transparency and Trust in Financial Transactions

USDC’s transparency and regulatory compliance help foster trust in the financial system. With regular audits and transparent backing, USDC offers a level of accountability that is often lacking in other cryptocurrencies. This transparency enhances trust among users, making it an attractive option for businesses and consumers alike.

Integration with Decentralized Finance (DeFi) Platforms

USDC has become an integral part of the decentralized finance (DeFi) ecosystem, allowing users to access a wide range of financial services, including lending, borrowing, and trading. By integrating USDC into DeFi platforms, users can take advantage of the stability and security offered by the stablecoin, while also participating in the innovative world of decentralized finance.

Risk Management and Fraud Prevention Strategies

The security features of USDC make it an ideal tool for risk management and fraud prevention. Blockchain technology ensures that every transaction is recorded on an immutable ledger, reducing the risk of fraud and double-spending. This makes USDC a more secure option compared to traditional payment methods, which are vulnerable to chargebacks and fraud.

Strategic Partnerships between Financial Institutions and Tech Innovators

As USDC gains traction, we can expect to see more strategic partnerships between financial institutions and technology companies. These partnerships will help drive innovation in the payments space, enabling the development of new financial products and services that leverage the power of blockchain technology.

Challenges and Considerations

Despite its many advantages, USDC and other stablecoins face several challenges. Regulatory compliance is a key issue, as governments around the world seek to establish clear guidelines for the use of digital currencies. Additionally, technical integration and interoperability concerns must be addressed to ensure seamless operations across different platforms.

Future Trends and Projections

The future of stablecoins looks promising, with growing adoption and integration across various industries. As regulatory frameworks evolve and blockchain technology continues to improve, stablecoins like USDC will play an increasingly important role in shaping the future of finance. We can expect to see more use cases beyond online gambling, including in remittances, e-commerce, and traditional banking.

Conclusion

USDC has established itself as a key player in the world of digital currencies, offering stability, speed, and security for financial transactions. Its role in online payment systems, particularly in high-stakes industries like online gambling, has demonstrated its potential to enhance user experience and streamline transaction processing. As the digital economy continues to evolve, USDC will likely play an even greater role in shaping the future of finance, offering businesses and consumers a stable and reliable alternative to traditional payment methods.